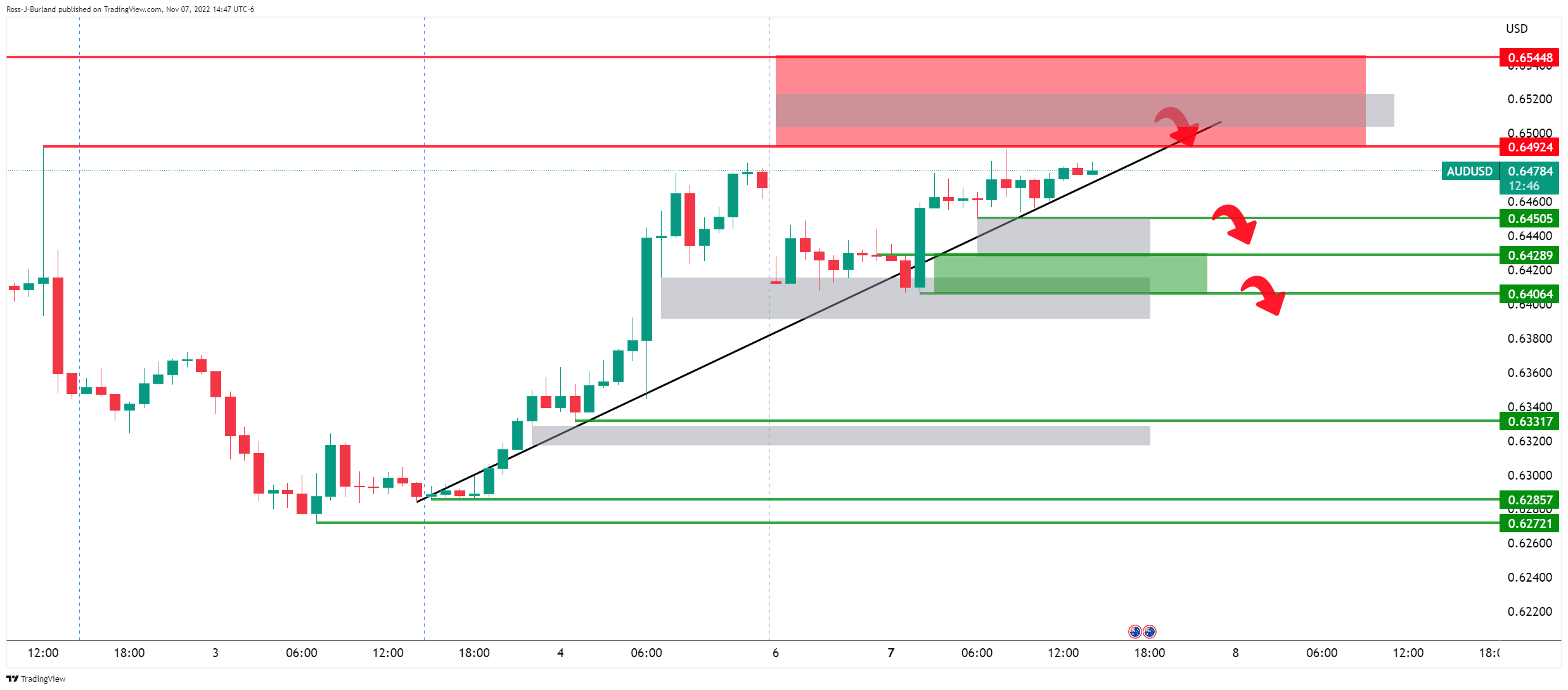

AUDUSD Price Analysis: Bears lurking around last week's highs

- AUDUSD bulls move in on last week's highs in a risk-on setting.

- A break of the highs will open risk to last month's highs, although trendline support could come undone.

AUDUSD has climbed at the start of the week, fididing demand due to a risk-on sentiment that emerged from last Friday's activity in the US session. There are signs of some easing of market conditions following last week's mixed Nonfarm Payrolls report that shows that the Unemployment Rate rose to 3.7%. Investors are hopeful that the much sought-after Federal Reserve pivot could be on the horizon that would give relief to global stock markets. Consequently, Us yields are stalling as the following technical analysis will show and AUDUSD is gathering pace on the bid into last week's highs:

AUDUSD H1 charts

The price is riding trendline support into last week's highs with the prior month's highs thereafter as targets for this week. However, there are a number of price imbalances that have been left behind for the start of the week's business ad the length of Friday's trade could be a target for the bears. If the bears commit at this juncture, then a break of 0.6450 could be significant and fuel interest from sellers. A move below the trendline support will be the first scenario to look out for in that regard.