When are the Eurozone final CPIs and how could they affect EUR/USD?

Eurozone final CPIs estimate overview

Eurostat will publish the Eurozone's inflation final estimate for June at 0900GMT today. Consumer prices are seen arriving at 2% on a yearly basis, confirming the flash estimate. While the core figures are expected to come in at 1% same as that reported in the first readout.

On a monthly basis, the CPI figure for June is seen sharply lower at 0.1% versus 0.5% previous while the core CPI is also expected to come in softer at 0.1% versus 0.3% last.

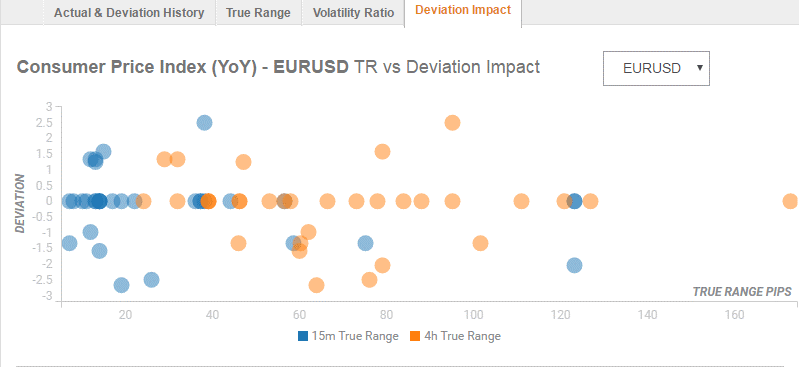

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 40 pips in deviations up to 1.5 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 50 pips.

How could affect EUR/USD?

On better readings, the EUR/USD pair could head back towards “1.1654 is the convergence of the Simple Moving average 10-1h, the SMA 50-15m, the one-day high and the SMA 5-1h. A minor line is 1.1641 which is the SMA 10-15m and the Fibonacci 38.2% one-month. Looking down, the road is smoother. Some support awaits at 1.1589 which is the meeting point of the Fibonacci 23.6% one-month and the Pivot Point one-day Support 2. Lower, some support awaits at 1.1557 which is the Bolinger Band one-day lower before the 2018 nadir of 1.1508. All in all, it is clear to see that rising is harder than falling.” Yohay Elam, Analyst at FXStreet explains,” FXStreet’s Analyst Yohay Elam explains.

Key Notes

Eurozone inflation data in focus today – Danske Bank

EUR/USD clattering into familiar lows as the Greenback surges ahead of the EU's CPI release

About Eurozone final CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).