AUD/USD knocks lower after Aussie Trade Balance shows declining imports

- The AUD slipped lower on a Trade Balance release with a poor underlying balance.

- Australian Retail Sales remains on the economic calendar for the week, rounding out the Aussie's action on Friday.

The AUD/USD is trading down into 0.7375 after slipping from the 0.7400 major level on a tricky Australian Trade Balance release that saw both Imports and Exports dip lower compared to the previous period.

Australia's Imports declined by -1%, while Aussie Exports contracted from 4% to 3%, leaving the Trade Balance figure lop-sided, which came in at a stellar $1.8 billion, far above the forecast $900 million, though with the contraction in imports leaving the balance of trade off-balance, traders are taking the overall reading to the downside. Friday brings Australia's Retail Sales figures, which will be a last chance for the AUD to inspire some bullish confidence this week.

Asia session currencies are seeing a retreat in risk appetite as trade headlines take the wind out of market sentiment's sails; US President Donald Trump confirmed he was looking to increase tariff rates on a planned $200 billion worth of Chinese goods from 10% to 25%, and broader markets are striking a cautious note in the face of rising trade tensions between the US and China, Australia's largest trading partner.

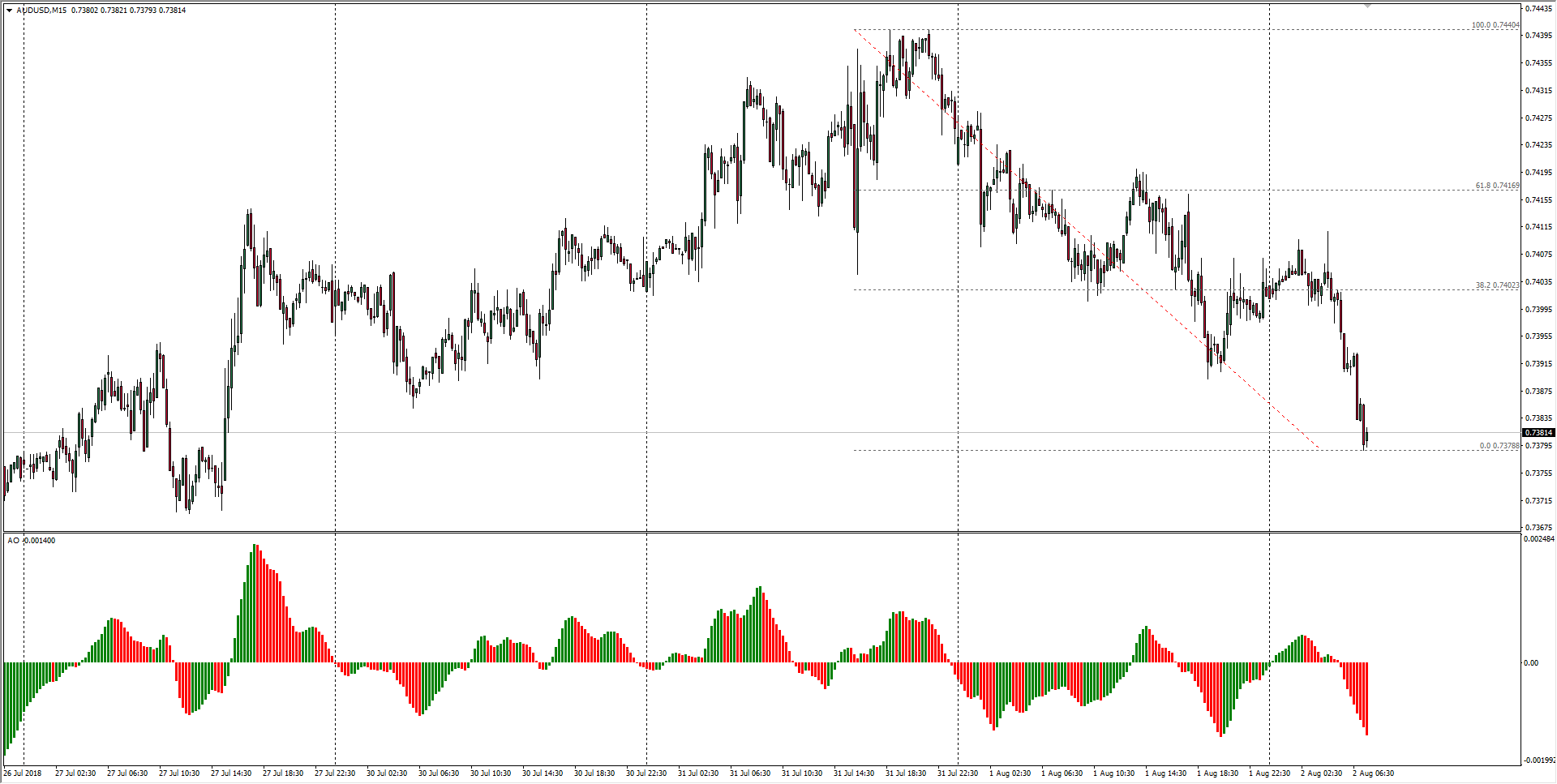

AUD/USD Technical Analysis

The Aussie is slipping into recent lows, though the AUD/USD's rough sideways channel remains in place, and directional momentum remains limited; the current drop from near 0.7450 is likely to face quick support as major pairs revert to their opening prices for the week.

AUD/USD Chart, 15-Minute

| Spot rate: | 0.7381 |

| Relative change: | -0.28% |

| High: | 0.7410 |

| Low: | 0.7378 |

| Trend: | Bearish |

| Support 1: | 0.7378 (current day low) |

| Support 2: | 0.7358 (previous week low) |

| Support 3: | 0.7317 (four week low) |

| Resistance 1: | 0.7410 (current day high) |

| Resistance 2: | 0.7400 (major technical level) |

| Resistance 3: | 0.7440 (current week high) |