S&P500 Technical Analysis: Bulls keep the market above 2,700.00 figure

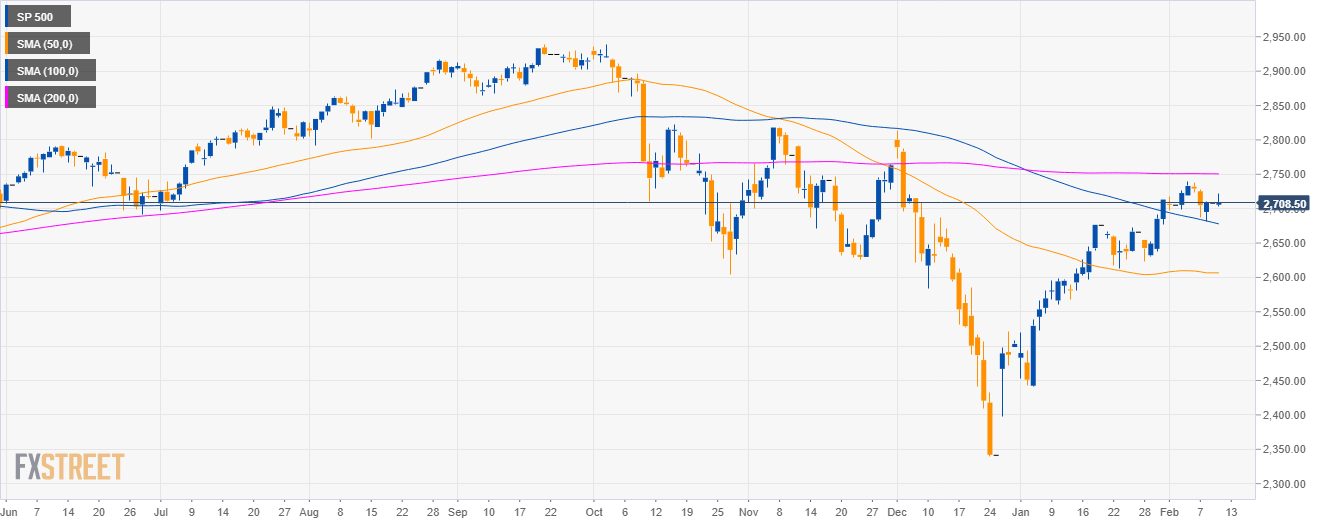

S&P500 daily chart

- The S&P500 Index is trading between the 100 and 200-day simple moving averages (SMAs) suggesting a sideways market.

- As discussed last Thursday, the market hit the 2,720.00 level to the upside.

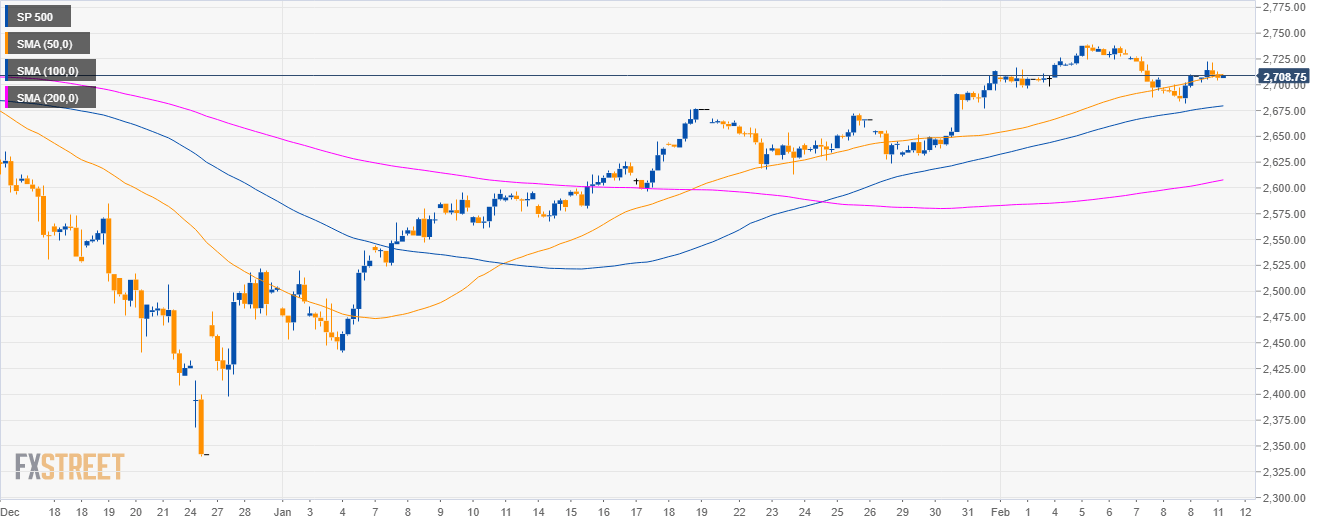

S&P500 4-hour chart

- The market found some support near the 2,700 figure and the 50 SMA.

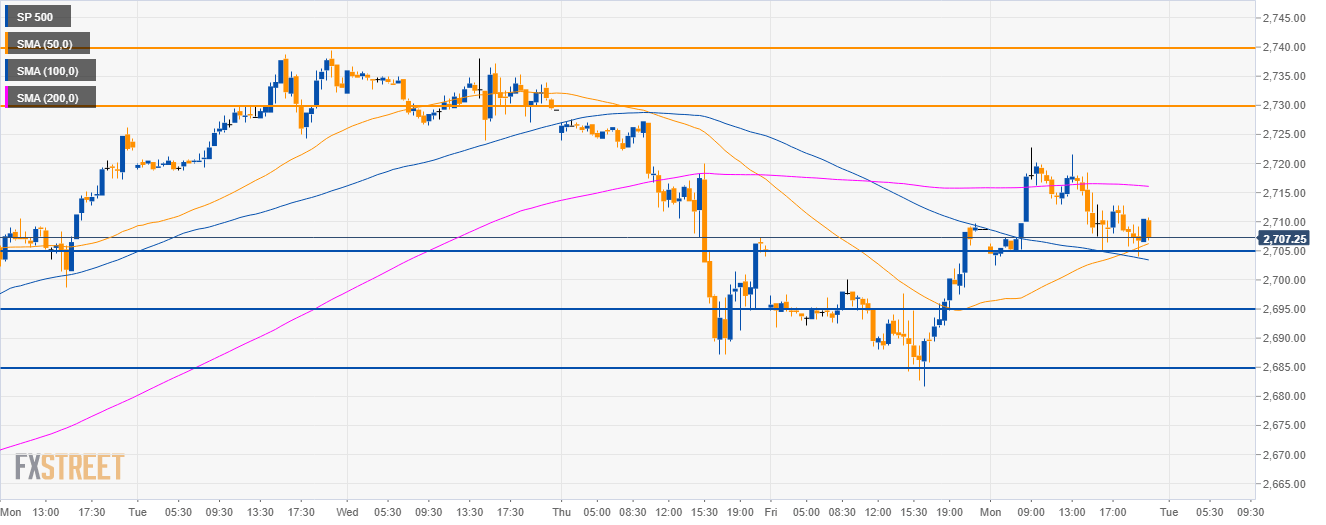

S&P500 30-minute chart

- The S&P500 is trading between the 100 and 200 SMAs suggesting a sideways market.

- The 2,730.00 resistance is the level to beat if bull want to continue the recent up move towards, 2,740.00 and 2,800.00 figure

- On the way down, supports are seen at 2,705.00, 2,695.00 and 2,685.00 levels.

Additional key levels

SP 500

Overview:

Today Last Price: 2710.5

Today Daily change %: 0.06%

Today Daily Open: 2708.75

Trends:

Daily SMA20: 2683.38

Daily SMA50: 2606.74

Daily SMA100: 2680

Daily SMA200: 2750.66

Levels:

Previous Daily High: 2708.75

Previous Daily Low: 2708.75

Previous Weekly High: 2739.5

Previous Weekly Low: 2681.75

Previous Monthly High: 2714

Previous Monthly Low: 2441

Daily Fibonacci 38.2%: 2708.75

Daily Fibonacci 61.8%: 2708.75

Daily Pivot Point S1: 2708.75

Daily Pivot Point S2: 2708.75

Daily Pivot Point S3: 2708.75

Daily Pivot Point R1: 2708.75

Daily Pivot Point R2: 2708.75

Daily Pivot Point R3: 2708.75