When is the US GDP report and how could it affect EUR/USD?

US Q2 GDP Overview

Thursday's US economic docket highlights the release of revised US Q2 GDP growth figures, scheduled to be published at 12:30 GMT. The second estimate is anticipated to show that the economic growth in the April-June quarter stood at 2.0% annualized pace as against the advance estimate of 2.1%, marking a sharp deceleration from the first quarter's final print of 3.1%.

as Joseph Trevisani - FXStreet's own Analyst explains - “The relatively small percentage of US GDP that stems from manufacturing, 12%-15% and the even smaller percentage due to exports 3%-5% are not sufficient to derail overall growth based on an expansive consumer. Their relative decline, however, has probably restricted economic activity to a 2.0%-2.5% range.”

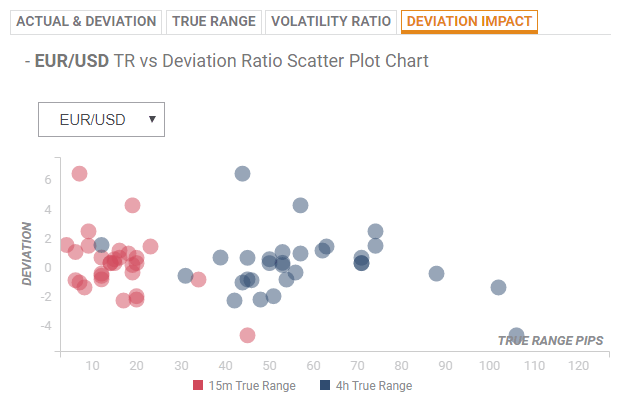

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction on the pair, in case of a deviation between +0.68 to -0.82, is likely to be in the range of 20-34 pips in the first 15-minutes and could extend to 45-pips in the following 4-hours.

How could it affect EUR/USD?

Ahead of the important release, Yohay Elam, Analyst at FXStreet provides important technical levels to trade the EUR/USD pair – “Support awaits at 1.1050, which provided support late last week. The next level to watch is 1.1027 – the 2019 low. 1.1000 and 1.0960 are next.”

“Resistance awaits at 1.1115, which has capped the pair several times in recent weeks. It is closely followed by 1.1130 – twice a support line – and by 1.1165,” he added further.

Key Notes

• US second quarter GDP 1st revision preview: Consumers are sufficient for 2%

• EUR/USD path of least resistance is down ahead of critical data – Confluence Detector

• EUR/USD analysis: Weak price action continues ahead of German CPI, US GDP

About the US GDP

The Gross Domestic Product Annualized released by the US Bureau of Economic Analysis shows the monetary value of all the goods, services and structures produced within a country in a given period of time. GDP Annualized is a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing. Generally speaking, a high reading or a better than expected number is seen as positive for the USD, while a low reading is negative.