Back

6 Apr 2020

Crude Oil Futures: Upside looks exhausted

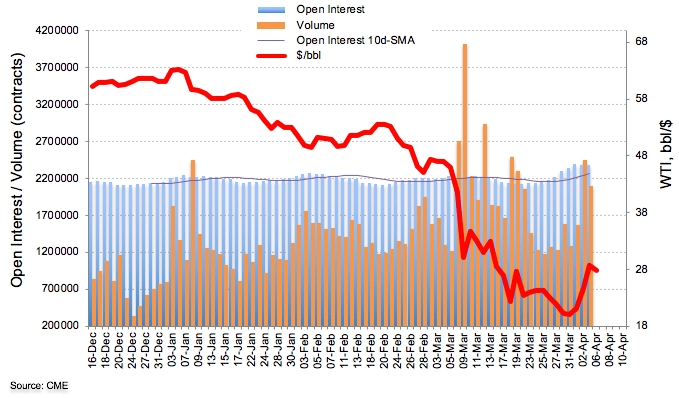

Advanced data for crude oil futures markets from CME Group noted open interest shrunk by nearly 1.5K contracts at the end of last week. In the same line, volume reversed two builds in a row and decreased by around 353.5k contracts, the highest single-day drop since March 23rd.

WTI faces strong barrier at $30.00/bbl

Friday’s recovery in prices of the barrel of WTI were amidst declining open interest and volume, suggesting the presence of short covering behind the recent upside. That said, and with the $30.00 mark per barrel capping the upside, the door remains open for the resumption of the downtrend in the very near term at least.