EUR/USD bounces off lows post-ZEW, back around 1.0840

- EUR/USD rebounds from daily lows near 1.0820.

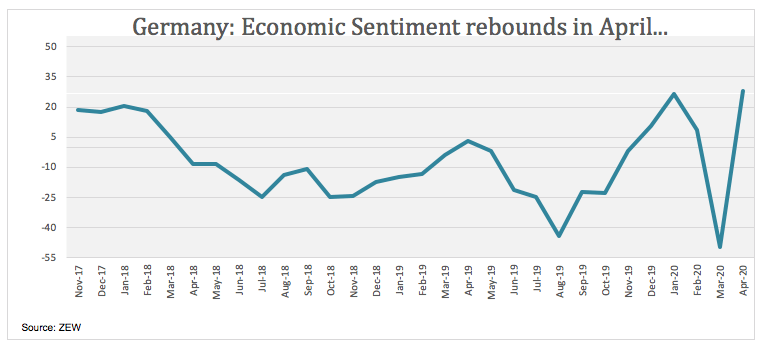

- German Economic Sentiment improved to 28.2 in April.

- The risk-off trade keeps bolstering the demand for the dollar.

After bottoming out in the 1.0820 region, EUR/USD has managed to regain some poise and is now returning to he 1.040 region at the time of writing.

EUR/USD improves after positive ZEW reading

EUR/USD remains sidelined although within a bearish note above the 1.0800 mark so far in the first half of the week, always against the backdrop of the solid demand for the greenback.

However, the pair has managed to lure in some buyers on Tuesday in response to better-than-expected results from the ZEW survey. Indeed, the Economic Sentiment in both Germany and Euroland improved to 28.2 and 25.2, respectively, sharply reversing the contraction recorded in the previous month.

Moving forward, investors are expected to scrutinize the Eurogroup meeting on Thursday, with the debate of potential extra stimulus aimed at helping in the economic recovery of the coronavirus aftermath on top of the agenda.

What to look for around EUR

The euro remains on a bearish note at the beginning of the week, always looking to developments from the coronavirus and its impact on the economy as the main driver of both sentiment and price action. On the more macro view, the single currency is expected to remain under scrutiny in the next periods in light of the forecasted contraction in the economy of the region in the first half of the year, relegating hopes of a strong recovery to Q3 and/or Q4.

EUR/USD levels to watch

At the moment, the pair is losing 0.18% at 1.0841 and faces immediate contention at 1.0812 (weekly low Apr.17) followed by 1.0768 (monthly low Apr.6) and finally 1.0635 (2020 low Mar.23). On the upside, a breakout of 1.0990 (weekly/monthly high Apr.15) would target 1.1048 (200-day SMA) en route to 1.1147 (weekly high Mar.27).