USD/IDR Price News: Indonesian rupiah struggles for direction near two-week low

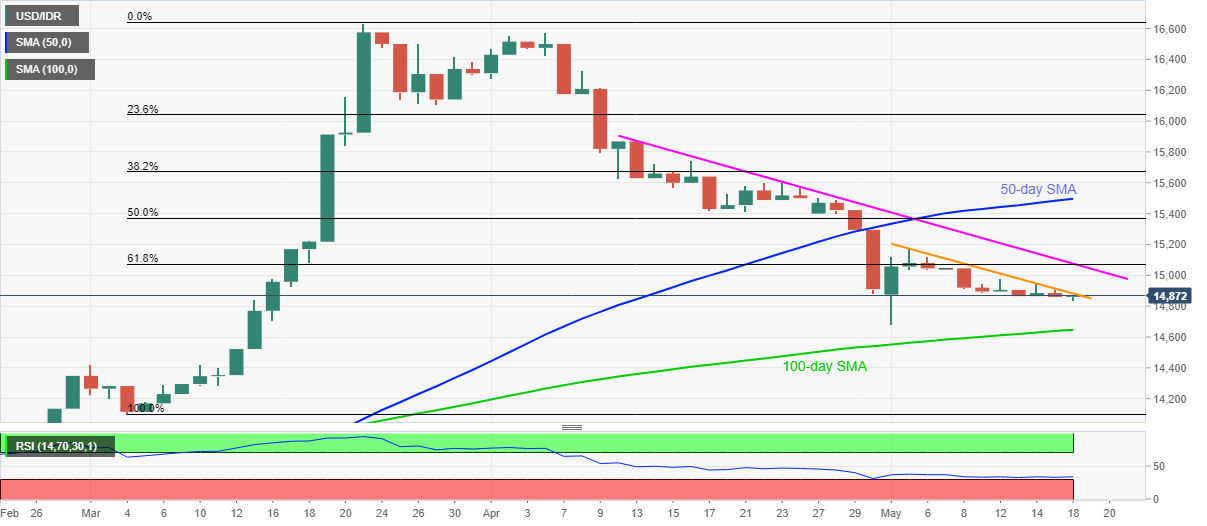

- USD/IDR recovers from two-week low amid oversold RSI conditions.

- Sustained trading below 50-day SMA, the monthly resistance line keeps bears hopeful.

- 100-day SMA adds to the support below the month’s low.

USD/IDR bounces off a two-week low of 14,863 ahead of the European session on Monday. Even so, short-term falling trendline, as well as a sustained trading below 50-day SMA and monthly resistance line, keeps sellers hopeful.

Though, oversold RSI conditions favor the pair’s pullback moves, which in turn push buyers for fresh entries on the break of 14,885 immediate resistance line.

However, a confluence of 61.8% Fibonacci retracement of March month upside and a falling trend line from April 13, around 15,070/75, could keep the pair’s further recoveries under check.

If at all USD/IDR prices rise beyond 15,075, 50% Fibonacci retracement and 50-day SMA, respectively near 15,370 and 15,500, will lure the bulls.

On the contrary, the pair’s further downside could take rests on the monthly low of 14,678, as well as 100-day SMA level of 14,648, ahead of looking towards the early-March top near 14,420.

USD/IDR daily chart

Trend: Pullback expected