Back

1 Jun 2020

EUR/USD Price Analysis: Prints five-day winning streak above 1.1100

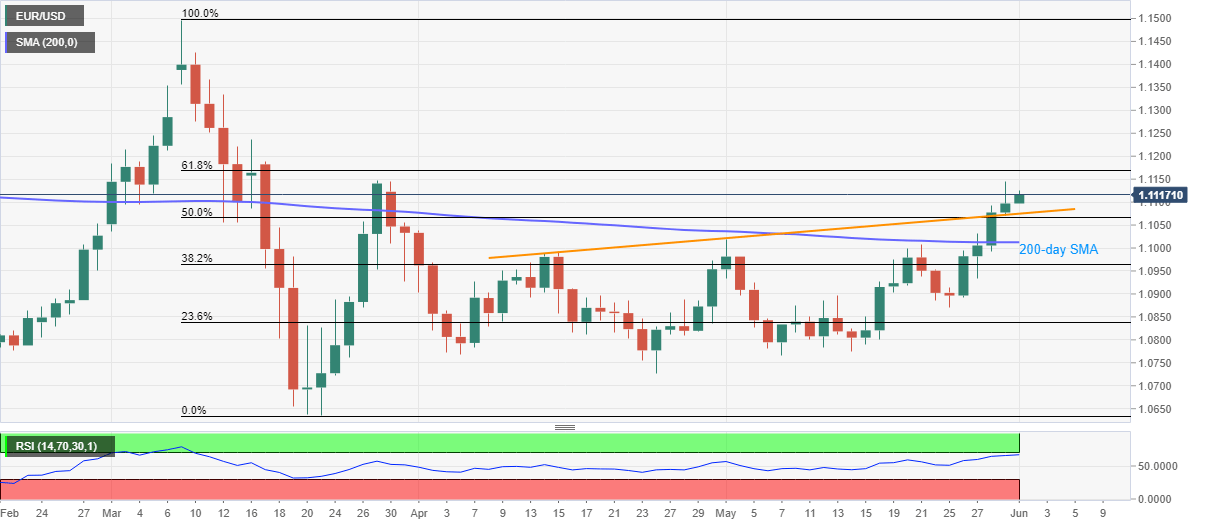

- EUR/USD takes the bids near a nine-week top near 1.1150.

- Sustained trading above resistance line stretched from April 14 keeps the buyers hopeful, 200-day SMA adds to the support.

- 61.8% Fibonacci retracement acts as immediate resistance ahead of mid-March high.

EUR/USD rises to 1.1120, up 0.20% on a day, during the Asian session on Monday. While keeping the sustained trading above the short-term resistance line, now support, the quote stays near the highest since March 30, 2020.

However, overbought RSI conditions seem to challenge the pair’s further downside.

As a result, bulls are waiting for a fresh run-up beyond March 27 high 1.1147 to challenge 61.8% Fibonacci retracement level around 1.1170.

During the quote’s further advances past-1.1170, March 16 peak nearing 1.1240 could flash on the buyers’ radars.

Alternatively, a daily close below the resistance-turned-support line, currently around 1.1075, could drag the quote back to a 200-day SMA level of 1.1012.

EUR/USD daily chart

Trend: Bullish