WTI Price Analysis: Bears firming grip below $58.00

- WTI struggles to extend corrective pullback from Tuesday’s low.

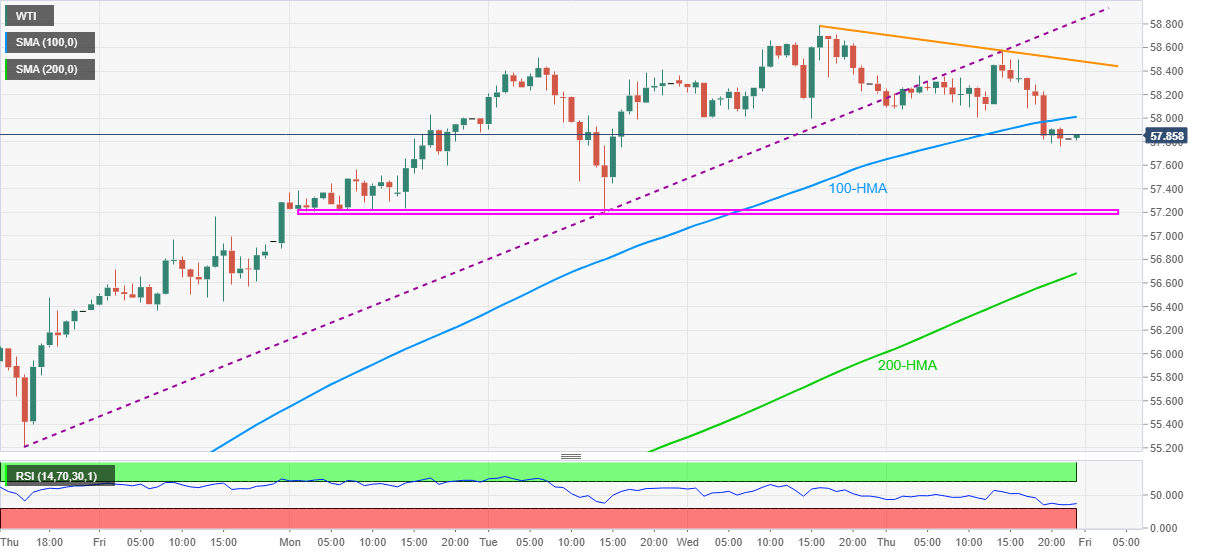

- 100-HMA, immediate falling trend line guards short-term upside.

- Previous support line, Wednesday’s multi-month high offer tough resistance.

WTI stays pressured below $58.00, currently around $57.80, during Friday’s Asian session. The oil benchmark dropped to the lowest in four days while snapping over a week-long upward trajectory. In doing so, the quote broke 100-HMA to the downside.

Other than the 100-HMA breakdown, a descending trend line from Wednesday also suggests further consolidation of gains by the oil traders.

As a result, a horizontal area comprising multiple lows marked during Monday and Tuesday, around $57.20, seems to return to the chart.

However, any further downside will be challenged by the 200-HMA level of $56.68, which if ignored should direct WTI bears to the monthly low surrounding $51.60 wherein February 04 bottom near $55.20 can act as an intermediate halt.

Alternatively, 100-HMA and the aforementioned immediate resistance line, respectively around $58.00 and $58.50, restrict the black gold’s short-term advances.

Also acting as the key upside hurdle is $58.80 comprising the previous support line from February 04 as well as the recently flashed 13-month high.

WTI hourly chart

Trend: Further weakness expected