EUR/USD Price Analysis: Retreats below 1.2100, bullish bias remains intact

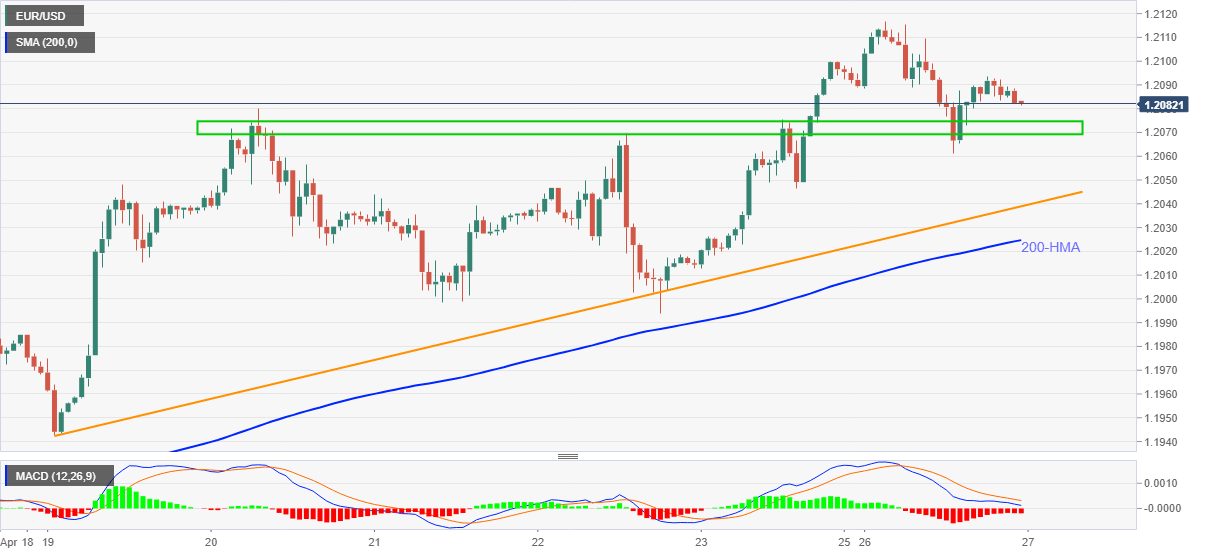

- EUR/USD extends pullback from two-month top but stays above short-term key supports.

- One-week-old horizontal area precedes immediate support line and 200-HMA to test the bears.

- Bulls need to cross a downward sloping trend line from early January.

EUR/USD drops to 1.2080, fades the late Monday’s bounce off 1.2061, amid the initial Asian trading session on Tuesday.

Bearish MACD and failures to stay strong around multi-day top suggest further consolidation of April’s gains.

However, a horizontal area comprising multiple levels marked since April 20, around 1.2070–75, restricts the short-term downside of the currency major pair.

Even if the EUR/USD sellers manage to conquer the 1.2070 support, an upward sloping trend line from April 19 and 200-HMA, respectively around 1.2040 and 1.2025, could challenge the quote’s further declines.

Meanwhile, fresh run-up needs to cross the 1.2100 nearby threshold before heading towards a descending resistance line from January, near 1.2120.

In a case where the EUR/USD bulls keep reins past-1.2120, the 1.2200 round-figure and February’s top close to 1.2245 should return to the charts.

EUR/USD hourly chart

Trend: Bullish